What is a Deposit Bond?

It’s a financial guarantee in the form of a digital certificate that acts as a substitute for a cash deposit when purchasing a property. It is not a loan.

What is a deposit bond?

It's a financial guarantee in the form of a digital certificate that acts as a substitute for a cash deposit when purchasing a property. It is not a loan.

A deposit bond requires an eligibility assessment to ensure you have the financial capacity to settle on your purchase, however it does not tie up your cash or assets. When you provide a deposit bond to the seller, this serves as a promise that the deposit amount will be paid at settlement.

With a deposit bond from Deposit Power, you can secure a property quickly and easily because there is no cash upfront – giving you extra time to sort out the cash deposit and pay the full 100% of the property value at settlement.

What it is

- A deposit guarantee

- Secure as cash

- Legal and trusted

- Widely accepted

What it isn’t

- A home loan

- A bank guarantee

- Expensive

- Full of red tape

Understanding deposit bonds

What is a deposit bond, and how does it work?

Essentially, a deposit bond provides a convenient, easy and flexible alternative to a cash deposit. Deposit bonds are especially useful if you’re waiting on funds from investments or property sales, but you want to secure a property now.

Deposit Power makes it easy to apply online for your deposit bond and have it approved in a matter of minutes. After you pay a flat, one-off fee (% of your deposit amount), we’ll send the digital approval to your phone. Then, you’re free to buy property at any time.

By using Deposit Power, you can purchase property while maintaining financial flexibility until the settlement date. Find out more about how deposit bonds work.

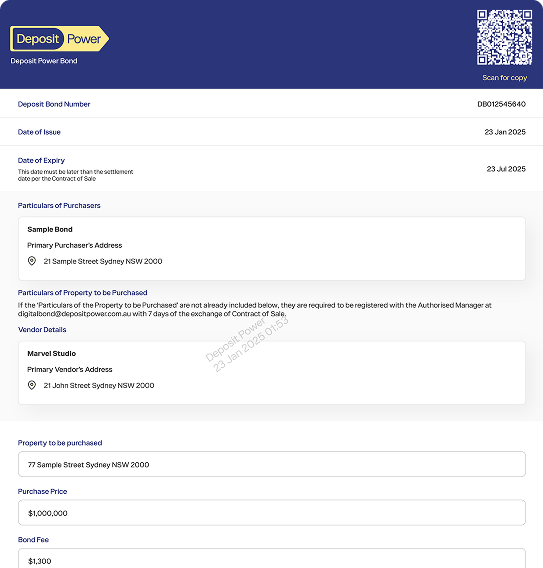

What is a digital deposit bond?

A digital bond is a secure, paperless and encrypted deposit bond.

Using QR technology, the bond can be securely shared between digital devices, enabling you to secure your new property faster. The QR technology allows parties to verify the authenticity of the bond through our website.

Digital deposit bonds streamline property transactions, eliminating the need for in-person meetings and extended waiting periods.

Whether purchasing at auction, off the plan, or for a standard property transaction, digital deposit bonds simplify the process – saving you time and giving you greater flexibility.

Is a deposit bond a loan?

No, a deposit bond is not the same as a loan. A loan is a financial arrangement where a lender provides money to a borrower, who agrees to repay the amount over time with interest. A deposit bond, on the other hand, essentially functions as an ‘I owe you’ – it’s a guarantee that you’ll pay the full deposit amount for a property at settlement.

No money is borrowed upfront when a deposit bond is issued. Instead, the buyer pays a one-time fee for the bond, and the full deposit amount is settled directly with the vendor at the property settlement date.

This distinction is important because a deposit bond doesn’t incur ongoing interest or require repayments, as loans do. It allows buyers to secure a property without needing to access their savings or borrow funds before settlement.

What can a deposit bond be used for?

Deposit bonds can be used in many scenarios – whether you’re:

Buying your first home

At an suction or private treaty

Buying an investment property

Residential or commercial

Buying Off-the-plan

Home and land packages, residential, commercial

What are the benefits of a deposit bond?

Cash flow

By using a deposit bond instead of paying a cash deposit upfront, you can keep your funds in more lucrative investments or savings accounts, avoiding the need to tie up a large sum of money during the purchasing process.

Convenience

For buyers involved in competitive situations like auctions or private sales, deposit bonds provide convenience. Rather than scrambling to provide a large upfront cash deposit, a deposit bond allows you to move quickly and confidently to secure the perfect property.

Easy and fast

Deposit bonds are easy to obtain, you can apply online and have your application approved almost instantly. Because you only pay a small one-time fee for a deposit bond, this method is also very cost effective.

Secure & trusted

Our deposit bonds are the highest rated deposit bonds in Australia – “AA-” Rated Very Strong, same as the big 4 banks. You can’t get more secure than that. We are backed by HDI Global Specialty SE, a global secure and established international insurer

Providing additional assurance to buyers and vendors / sellers

For vendors and sellers, saying ‘yes’ to deposit bonds can attract more buyers – which can lead to a higher sale price. A deposit bond also guarantees the deposit payment (since it’s a legally-binding agreement), which provides added peace of mind.

Vendor / Seller

Peace of mind

-

More prospective buyers

- Reputation

- Legally binding

- Provider guarantee

Buyer

More buying power

- Clear understanding of terms

- Credibility check

- Reputation

- Trusted and widely accepted

What are the risks of a deposit bond?

While a deposit bond is a flexible and convenient solution for securing a property, it’s also a legally binding contract. It’s important to be aware of the terms and conditions when you apply for a deposit bond, as failure to settle the property purchase on the agreed date could result in legal and financial consequences.

Deposit Power is a globally secure and trusted company with an AA- (Very Strong) rating: the highest credit rating for deposit bonds in Australia. Although there are still responsibilities tied to using our deposit bonds, buyers and sellers will have the assurance that comes from knowing that we take security seriously, and we’re here to guide you through the process.

Does a deposit bond expire?

Yes, all deposit bonds have an expiry date. A deposit bond expires when:

-

The contract of sale is completed; or

-

The Authorised Manager on behalf of the Underwriter pays the amount required to be paid under this Deposit Bond; or

-

The contract of sale is terminated or rescinded and, in either case, the vendor has accepted in writing the termination or rescission and the purchaser is entitled to a refund of the deposit; or

-

It is 5:00pm Sydney time on the earlier of the date of expiry or, if the date of expiry falls on a weekend or a public holiday in Sydney, the immediately preceding business day.

If your property settlement date changes or if you need extra time, you can often renew or extend the deposit bond. Deposit Power offers flexibility in extending the bond’s validity for an additional fee. This flexibility can help you manage unexpected delays while still maintaining the security of your property transaction.

How long does a deposit bond last?

Deposit Power offers short and long-term options with different terms.

In certain circumstances, Deposit Power can allow extensions if needed. If, for example, there are delays in the settlement process or the property type involves a longer settlement window, the bond can be extended for an additional fee.

Short-term bonds

From 0 to 6 months

Can be used to secure:

- An established property

- Residential

- Commercial

- Investment

Long-term bonds

From 7 to 66 months (5.5 years)

Can be used to secure:

- Off-the-plan

- Under construction

- Home and land packages

- Vacant land

How secure are Deposit Power Bonds?

Deposit Power bonds are “AA-” (Very Strong) rated from S&P!

We’ve been issuing deposit bonds in Australia for over 30 years. Our deposit bonds are widely accepted by real estate agents, solicitors, conveyancers and vendors – making us trustworthy, reliable and secure.

Australia’s highest rated deposit bonds!

Underwritten by HDI Global Specialty SE with an “AA-” (Very Strong) credit rating from Standard & Poor’s, for strength and security you can trust.

Deposit Bonds in Australia

Should I accept a deposit bond in Australia?

A deposit bond from Deposit Power is legally valid and available in all states and territories in Australia.

Deposit Power has been issuing deposit bonds in Australia for over 30 years and are widely accepted by real estate agents, solicitors, conveyancers and vendors.

Additionally, Deposit Power bonds are underwritten by HDI Global Specialty SE (HDI). HDI holds a financial strength rating of AA- from Standard & Poor’s and A+ from A.M. Best, making Deposit Power the highest rated deposit bond provider in Australia.

In the event the purchaser is unable to settle, you or your legal representative can submit a claim to Deposit Power. We process and pay 100% of all valid claims in Australia within 2 business days.

Who issues deposit bonds in Australia?

In Australia, deposit bonds are issued by a variety of providers, including specialist companies that focus specifically on financial guarantees for property transactions. These providers work with buyers and sellers to facilitate property deals by offering an alternative to cash deposits.

The bonds are typically underwritten by large, reputable insurers, ensuring that they provide the same level of security and assurance as a traditional deposit.

Deposit Power is one of Australia’s leading issuers of deposit bonds. We’re trusted and well-established, offering streamlined and flexible solutions for all sorts of property buyers.

Buyers using Deposit Power benefit from the backing of a globally secure and AA- rated insurer, ensuring both peace of mind and reliability throughout the property transaction process.

Why choose Deposit Power Bonds?

If you can afford the property, we’ll cover the deposit.